尽管新冠疫情前景尚未完全明朗,其对亚太地区写字楼租户的干扰正在减少。在灵活办公和新型工作模式日益普遍的趋势引导下,区域内企业已经在重启对不动产策略的长期规划。

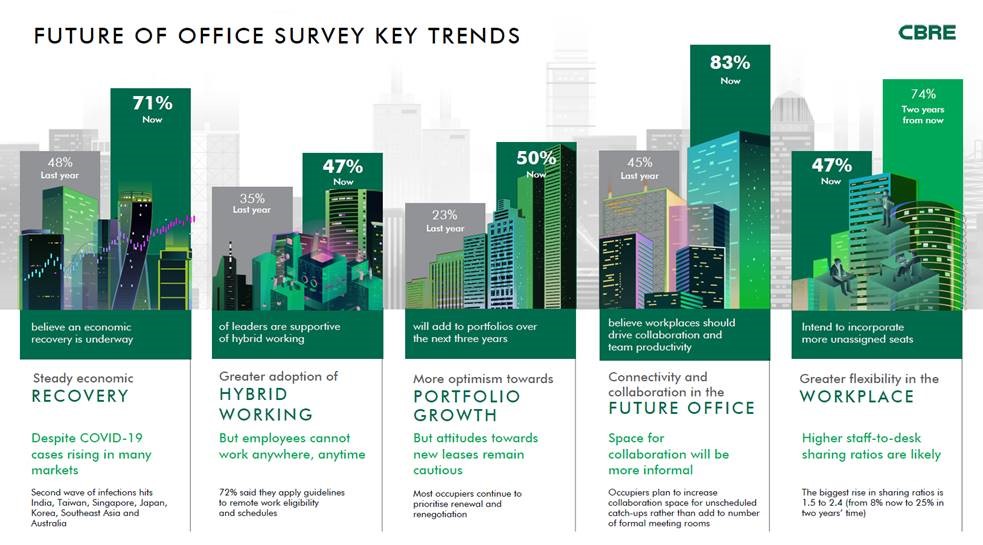

针对“新常态”之下的写字楼发展和企业租户的应对措施,CBRE世邦魏理仕于5月启动了《未来的办公场所——2021年亚太区写字楼租户调查》,并于近期发布调查结果,确立了“区域内经济稳步复苏”、“企业不动产组合规模增长预期提高”、“混合办公趋势上升”、“未来的工作场所将更重视促进沟通与协作”、“企业将实施更具灵活性的工作场所设置”等五个主要的写字楼趋势。

该项针对亚太区各地不同行业写字楼租户的调查发现,大部分(71%)受访企业都认为企业经营环境正持续改善,这一比例显著高于2020年4月(22%)与10月(48%)的两次调查结果。其中,大中华区和太平洋地区受访企业的市场信心水平最高,而印度和东南亚地区企业对市场的乐观程度则相对较低。

Download the Report Read MoreWith many markets succeeding in containing the pandemic and relaxing restrictions on business and social activity to some degree over the past six months, this year has seen a significant improvement in business sentiment across Asia Pacific. About 71% of survey respondents believe current business conditions are improving, marking substantial progress from the two surveys CBRE conducted in October and April 2020. Confidence was highest in Greater China and the Pacific, while India and Southeast Asia were less optimistic as they struggle to contain a new wave of infections. The unpredictability of infection rates will continue to weigh on the pace of the regional recovery for the foreseeable future. However, the rapid increase in vaccination rates in mature Asia markets and the reopening of offices globally will further strengthen corporate confidence in the handling of the pandemic.

Top real estate and finance executives gathered in Singapore to discuss the opportunities and challenges ahead for the region’s real estate industry at an event hosted by the Asia Pacific Real Assets Association (APREA).

Jointly organized by APREA, SS&C and Intralinks, the event, “Accelerating Technology in the New Normal of Real Assets,” the livestreamed event covered a wide range of issues transforming the industry, from real estate data to ESG (Environmental, Social and Governance) goals.

ある調査会社によると、今年上半期におけるある調査会社によると、今年上半期におけるオーストラリアへの不動産投資は対前年比で倍増となり、コロナ対策を着実に行い一定の成果を示し続けているオーストラリアに対する投資家の注目度は高い。こうした状況を踏まえ、このほどAPREA はオーストラリア不動産市場の現状や税務に関するWebinar を開催した。今回は市場概要をお届けする。

コロナ対策に一定の成果コロナ対策に一定の成果経済回復は早期に実現

メルボルンでのロックダウン期間は長かったもメルボルンでのロックダウン期間は長かったものの、オーストラリア政府はコロナウィルス対策を効果的に行い封じ込めに成功したと言えるであろう。オーストラリアの感染人数は約3万人、総人口のたった0.12%に過ぎない。政府は景気刺激策に2000 億ドル超を投入、事業主に対しては雇用継続向けに900 億ドル超の賃金支援を行った。ただ、シドニーは変異株の流行により先週から2週間のロックダウンが行われている。ワクチン接種率はほかの先進国よりはやや遅れておりまだ人口の1/4 程度だが、今後は順調に接種が進む予定である。

金利引き下げ策および量的緩和策の実行金利引き下げ策および量的緩和策の実行により国債利回りは低いため、不動産利回り同様魅力的なスプレッドとなっている。政策金利は0.1%で、コアの負債コストは140~190bp の範囲に収まると予想している。コロナウィルス感染拡大は28 年ぶりのリセッションをもたらし、2020 年第2四半期のGDP は7%の落ち込みを示したが、回復は早く2021 年3月の数字は1.1%と、パンデミック以前のレベルまで持ち直1.1%と、パンデミック以前のレベルまで持ち直し2022 年は3.5%、2023 年は3%と予測されている。

前回のリセッションと比べ失業率は急激に悪前回のリセッションと比べ失業率は急激に悪化したものの、回復も早く2021 年3月は5.1%まで回復しており、政府の支援策が功を奏したとのようにも見える。セ

Download the Report Read MoreWith the need for quality and cost-effective manufacturing becoming even more necessary due, to the disruption and economic implications of COVID-19, and global corporations looking to diversify their manufacturing bases and de-risk their supply chain, India has spotted an opportunity to capitalize on this strategic shift.

India has been active on the policy front and is paving the way to become the world’s most preferred manufacturing hub. The Production Linked Incentive (PLI) scheme is the cornerstone of the Indian government’s masterplan to boost domestic manufacturing and make it globally competitive. Introduced in April 2020, the scheme has set in motion aseries of game-changing reforms that will attract global manufacturing majors with a focus on sectors such as mobilephones, electronics, pharmaceuticals, food processing, IT, battery storage, automobile components and specialty steel.The core objective is to signal a turning point for Indian Industry and gain a global presence while boosting economicgrowth through job creation.

A measure of the government’s seriousness and the scale at which it is pushing the scheme is its outlay: Rs 1.97 lakhcrore, or $26 billion, across 13 key sectors. The highlights are:

● Linking incentives to output: Incentives will be based on the overall rate of growth in that industry. Beneficiarieswill have to consider additional investments in greenfield facilities or even to carry out facility expansions toachieve this increment. All of this will reduce imports too

● Results matter: Incentives will be disbursed only after production has taken place in the country. This will boostexisting capacities in domestic manufacturing for sunrise and strategic sectors, and make domestic manufacturing globally competitive

● Creating ‘champions’ to maximize impact: The focus is on size and scale for the selected industry players todeliver volumes. This will make it exceedingly effective and can make the beneficiaries globally competitive

Download the Report Read More