Addressing Scope 3 emissions has become increasingly vital in real estate, driven by rising expectations from investors, regulators, and stakeholders for meaningful climate action. According to the World Green Building Council, buildings account for around 39% of global energy-related carbon emissions. Of this total, around 11% is attributed specifically to embodied carbon emissions, which arise from materials and construction. With the building operational efficiencies continuously to be improved and electricity grids to be decarbonised, embodied carbon emissions represent a progressively larger proportion of total emissions. Hongkong Land has a long history of enhancing energy efficiency and reinvesting in existing assets, Scope 3 emissions represent nearly 90% of our total emissions. As a developer and owner of buildings, prioritise initiatives to address embodied carbon measurement, monitoring and reduction along the supply chains is crucial.

Hongkong Land’s Commitment to Scope 3 Emissions Reduction

Our 1.5°C aligned near-term science-based targets is to reduce 22% carbon intensity for Scope 3 greenhouse gas emissions by 2030. As the first Hong Kong-based developer to create bespoke embodied carbon assessment tools. These tools adopt a supplier-based approach to estimating emissions and provide a level of granularity. Hongkong Land integrates these across project design, tendering, and construction. The company actively collaborates with industry partners to standardise procurement guidelines, focusing specifically on five key construction materials: cement, concrete, façade, rebar, and structural steel.

Case Sharing on New Development in Shanghai

Hongkong Land's Westbund Central is the Group’s largest-ever single investment, it is an US$8 billion development encompassing approximately 1.1 million sq. m. of prime mixed-use property strategically located at Shanghai's Xuhui Waterfront. Westbund Central demonstrates Hongkong Land's proactive and strategic approach to embodied carbon management. Utilising our bespoke embodied carbon assessment tools, the project team systematically measures the embodied carbon intensity associated with the development. The team closely reviews construction materials and actively pursues opportunities to minimise embodied carbon through targeted optimisation efforts. By applying detailed schematic design analyses and structural material optimization techniques, the project has already achieved significant reductions. Specifically, these optimisation strategies have resulted in a achieving a 16% overall carbon reduction in structural steel and a 7% in concrete.

Westbund Central, China

Case Sharing on Transformation of LANDMARK in Hong Kong

Hongkong Land's Tomorrow’s CENTRAL project, a plan to invest over US$400 million by expanding and upgrading its LANDMARK retail portfolio over a three-year period, has established an ambitious target to divert at least 75% of total construction waste by weight from landfills. Before commencing refurbishment works, we conducted a comprehensive pre-refurbishment audit, systematically assessing and analysing the waste likely to be produced from demolition activities. The audit provided a clear, quantitative overview of anticipated waste streams and identified actionable opportunities for reclaiming, reusing, and recycling materials, guiding contractors to maximise resource recovery and circularity.

We identified 15 major construction materials and products including concrete, glass, wood, metal, and others for prioritised reuse, circular recycling, and diversion from landfills. By integrating circular economy principles, the project reduces demand for new raw materials, diminishes waste disposal volumes, and significantly lowers embodied carbon emissions associated with material extraction, manufacturing, transportation, and disposal.

LANDMARK ATRIUM, Hong Kong

Conclusion

Through these targeted initiatives and strategic actions ranging from bespoke embodied carbon assessment tools and structural design optimisation at West Bund, to comprehensive pre-refurbishment audits and circular material reuse strategies in Tomorrow’s CENTRAL. Hongkong Land demonstrates a robust and proactive approach to reducing embodied carbon emissions. We will continue to make significant strides towards sustainability targets 2030.

Head of Investor Relations & ESG Engagement

Hongkong Land

Email:This email address is being protected from spambots. You need JavaScript enabled to view it.

The global real estate sector faces mounting pressure to decarbonise, contributing nearly 40% of total emissions (1). With the 2050 net-zero target fast approaching, investors and asset managers must urgently align with evolving ESG standards or risk falling behind.

Europe: Regulatory Leadership and Standardisation

Europe leads the way in ESG integration with rigorous regulatory frameworks. The EU Taxonomy for Sustainable Activities (2) provides a clear classification system for environmentally sustainable investments, guiding capital allocation towards green real estate. Additionally, the Global Real Estate Sustainability Benchmark (GRESB) (3)—originally developed in Europe—has become a widely accepted ESG performance measurement tool, shaping investment decisions worldwide.

GRESB’s influence extends beyond Europe, particularly into the Asia-Pacific (APAC) region, where a joint study with ANREV found that higher GRESB scores correlate with stronger financial performance. This has encouraged investors and developers across APAC to integrate sustainability benchmarks into asset management, enhancing ESG disclosures and compliance.

United States: Market-Driven ESG Adoption

Unlike Europe’s regulatory-first approach, the US real estate sector is driven by market incentives and investor demand. The Inflation Reduction Act (2022) promotes building efficiency and renewable energy adoption, while major cities have introduced stringent local policies. New York City’s Local Law 97 (4) mandates a 40% reduction in building emissions by 2030, penalising non-compliance with significant financial consequences.

Beyond regulation, major institutional investors such as BlackRock and Brookfield have embedded ESG principles into real estate portfolio strategies. The increasing willingness of tenants to pay a premium for energy-efficient spaces further highlights the market-driven shift towards sustainability.

Asia: Diverse Strategies Across Developed and Emerging Markets

Asia’s real estate ESG trends vary by region. China is focusing on large-scale sustainable urban developments as part of its 2060 carbon-neutral goal. Japan and South Korea are leveraging smart-grid technology and AI-driven energy management to improve efficiency and emissions tracking.

In Southeast Asia, where economies are still developing, international financial support is playing a crucial role in accelerating sustainability efforts. Singapore, for instance, has seen rapid growth in green-certified buildings, with investors aligning assets to Task Force on Climate-related Financial Disclosures (TCFD) (5) and Science-Based Targets (SBTi) (6) recommendations to improve transparency and global compliance.

A Global Shift Towards Sustainable Real Estate

Despite regional differences, ESG integration in real estate is becoming a global imperative. Investors, developers, and asset managers must navigate evolving standards while ensuring properties remain competitive in an increasingly sustainability-driven market.

To remain ahead, real estate leaders must proactively:

As the real estate industry moves toward a net-zero future, those who embrace sustainability will protect long-term assett value and strengthen their market position. The shift from regional approaches to a globally integrated ESG strategy is already underway—now is the time for decisive action.

References:

Managing Director

Longevity Partners

The revitalisation and redevelopment of an asset is not just a straightforward renovation of the physical facilities of a property but can also be a chance to improve on sustainability, community engagement and cultural integration of the entire area. A thoughtful asset manager can also take the opportunity to rebrand and enhance its offerings through a renewed experience for its visitors.

Located along the Singapore River in the heart of the city, the recently transformed CQ @ Clarke Quay (CQ) bustles with excitement and entertainment with its myriad of retail and lifestyle experiences for locals and tourists alike. Offering options for both day and night, the area’s historical charm and modern amenities blend together seamlessly to provide a unique atmosphere.

Lesser known is that sustainable features have been incorporated into its redevelopment that not only have a positive impact on the environment, but also enhance wellness and comfort of the community.

Approximately 34% of its recent rejuvenation cost was allocated towards improving operational efficiency and integrating sustainable building features. Because of these enhancements, CQ’s green rating has been elevated from Green Mark Certified to Green Mark GoldPLUS, both green building ratings conferred by the Building and Construction Authority (BCA) in Singapore.

Existing angel canopies were upgraded with advanced ethylene tetrafluoroethylene (ETFE) membranes to increase thermal comfort.

Although naturally ventilated, visitors enjoy a comfortable stroll down the inner streets of CQ due to the upgraded angel canopies made with advanced ethylene tetrafluoroethylene (ETFE) membranes that optimise the entrance of daylight while also reducing solar heat gain by 70%. New omni-directional fans have been installed, lowering the environmental temperature by approximately 2°C through evaporative mist cooling while reducing energy consumption by approximately 50% compared to standard fans. CQ’s property management systems were enhanced, including the upgrade of the building chiller plant to attain a system efficiency of 0.60kW/RT.

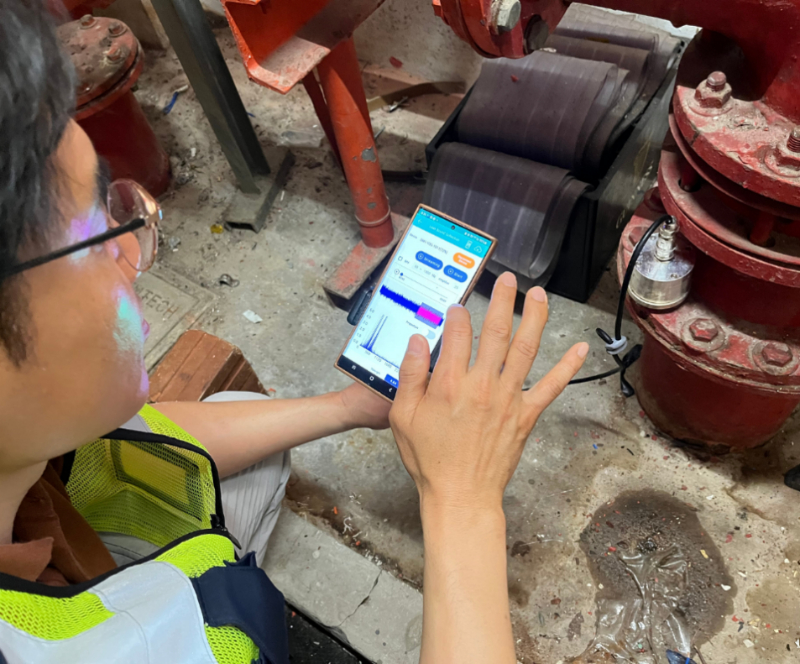

The WI.Plat technology is able to identify pipe leakages using an IoT sensor.

During the enhancement, the team took the chance to identify other rectification works required, including the detection of pipe leakages to prevent water loss and property damage. But with an extensive network of underground pipes beneath the historical structures, this process was complex and tricky. WI.Plat, a CapitaLand Sustainability X Challenge innovation, came in handy. It is a high-precision acoustic IoT sensor technology from Korea with a machine learning algorithm that identified otherwise difficult to locate underground pipe leaks.

Mural artwork by Yip Yew Chong and tobyato fronting Block B - The Warehouses

Many who visit CQ may not be familiar with its rich culture and legacy, including its past life as a major transshipment zone and a conduit for trade, where cargo from the tongkangs and twakows, historical cargo vessels, would be manually unloaded along the river. Seven warehouses were restored, preserving their godown typology while being adorned in new colours. Heritage jack roofs were reinstated and glass skylights incorporated to draw in natural light. The warehouse façades were painted with mural by local artists Yip Yew Chong and tobyato inspired by Clarke Quay’s heritage as a Teochew enclave. Upgraded steps doubling up as seats were added to the landing of Read Bridge, paying tribute to the Bridge’s historical role as a communal space, complemented by a new accessibility ramp incorporating upcycled wood pieces from the last two twakows. Furthermore, heritage panels and bronze plate tiles, strategically positioned throughout the area, recount the enthralling history of the Singapore River and Clarke Quay precinct, serving as educational elements for visitors as they explore the area's rich heritage.

CQ has also been enhanced with modern and exciting offerings and new retail concepts. Fairprice Finest Clarke Quay offers products in collaboration with Singapore- based partners and its Grocer Food Hall offers “You Pick, We Cook” services as well as curated cocktails infused with local flavours. Swee Lee Clarke Quay is housed in an approximately 60% of repurposed warehouse unit housing an experiential and community space and pet-friendly amenities.

Chief Sustainability & Sustainable Investments Officer

CapitaLand Investment

As ESG adoption in real assets accelerates, identifying the right technology remains a complex challenge. There is no one-size-fits-all approach—ESG tools must align with a firm’s portfolio, investment strategy and data maturity. At the APREA Singapore Conference, industry experts emphasized the need for flexible, value-driven solutions.

For firms like SC Capital Partners, a private equity real estate firm managing over 60 assets across diverse classes in Asia-Pacific, agility and pragmatism in ESG strategy are essential. Unlike traditional developers with long-term investment horizons, SC Capital Partner follows an opportunistic investment strategy, where holding periods vary and assets may be divested ahead of schedule in response to market dynamics. This variability renders costly, rigid digital tools impractical, says Miak Ou, Director and Head of Sustainability at SC Capital Partners.

“Technology must align with a firm's ESG maturity, portfolio strategy and data readiness,” says Ou. “What works for a long-term core asset might not necessarily work for an opportunistic investment with a short and unpredictable holding period.”

Firms should prioritize value-driven adoption over trends. SC Capital Partners, for instance, currently uses a structured Excel-based system – developed with consultants – as it is flexible, cost-effective, and well-integrated with current workflows. Rather than invest in proprietary tools, the firm integrates with operators’ existing digital platforms to reduce implementation risk and accelerate adoption.

The edge lies not in the tool itself, but in the ability to measure, analyse, and apply data to make better investment decisions. While digital tools enhance tenant and guest experiences, Ou notes that smart building technologies are especially impactful in sectors like co-living, student accommodation, and self-storage, where they drive operational efficiency. In hospitality, innovations like mobile check-ins and smart room controls prioritize personalization over full automation.

Among the panelists, Esther An, Chief Sustainability Officer at City Developments Limited (CDL) highlighted the importance of the built environment in contributing to a net zero carbon future. She shared how CDL has leveraged green building and energy-efficient technologies and practices to reduce operation costs without compromising on users’ productivity and comfort founded on its ethos of ‘Conserving as We Construct’ established in 1995. She pointed to rising carbon taxes and grid prices that will require businesses for deeper and greater sustainability integration and innovation. Digital tools are key to improving ESG data collation, analysis and reporting to meet the rising expectation of regulators, investors and financiers, she said.

“Applying AI to improve business operations is definitely a no-brainer,” An, said. “ The key is on how do you deploy it efficiently to achieve the desired impact? Over the past 10 years, we have been saving an average of $3 to $4 million a year thanks to the effective application of energy-efficient technologies and practices.” AI-powered facility management platforms have helped us to optimize resource use through reducing lighting, air conditioning, and manpower deployment in underutilized spaces. This approach extends to car parks and large-scale infrastructure, reducing costs and improving operational efficiency, she noted. Temperature and grid prices will continue to rise, AI and technologies application to improve performance will be critical to future-proof businesses.

The Social Pillar: A Growing Focus in ESG

While governance and environmental concerns often dominate ESG discussions, the social pillar—spanning diversity, well-being and community engagement—receives less attention. However, demand for human-centric real estate is growing, particularly in student housing and senior living. Investors and tenants increasingly prioritize inclusivity, mental well-being and social impact.

Real estate leaders must integrate social impact in ESG strategies to enhance community well-being, said Tan Szue Hann, Head of Sustainability (Real Estate), and Director of ESG Strategy (Fund Management) at Keppel Ltd. Keppel Bay Tower, Singapore’s first net-zero office building, exemplifies this with efficient air handling, smart lighting, improved air quality, and tenant engagement, boosting sustainability and long-term occupancy.

“Keppel will not just take on a new tool or a new piece of technology because it's required, there has to be a certain efficiency in it, and there has to be a certain value that's created as well,” Tan said.

Sustainability in Building Design and Retrofitting

Environmental responsibility is key to ESG, but real impact requires going beyond compliance. Firms must balance regulations with proactive measures like green certifications, carbon reduction and energy-efficient retrofits.

Research and development in carbon capture and nature-based solutions underscore the need for tech-driven approaches, An highlights. Singapore, in particular, faces unique sustainability challenges due to heat, land scarcity and limited renewable energy options. Rising temperatures and cooling demands require energy-efficient solutions such as adding fans to improve ventilation alongside air conditioning and adoption of paint with cooling and purifying effect.

She advocated that Nature-based solutions will be the way forward as climate crisis cannot be resolved without tackling nature crisis.

Tan cites Seoul’s INNO88 tower as a model for sustainability-driven retrofitting. New urban regulations required removing three floors, but a conscious decision was made to retain the majority of the building’s structure, leading to a retrofit that preserved 30,000 tons of embodied carbon, while cutting operational energy use by 30%, saving SGD 1 million annually. The upgrade also boosted the building’s valuation, attracting investors.

SC Capital Partners applies Building Information Modelling (BIM) across all data centre developments under its SC Zeus platform, Ou notes. BIM is critical for optimising energy use and reducing waste—both key in energy-intensive assets like data centres. While adoption in Asia remains uneven, including in Japan and South Korea, the firm has made BIM a baseline requirement to support stronger ESG and operational outcomes from day one.Tan cites Seoul’s INO88 tower as a model for sustainability-driven retrofitting. Heritage regulations required removing three floors, leading to a retrofit that preserved 40,000 tons of embodied carbon and cut energy use by 30%, saving SGD 1 million annually. The upgrade also boosted the building’s valuation, attracting investors.

The future of ESG in real estate hinges on balancing governance, social impact and sustainability. Technology drives efficiency and compliance, but the real value comes from turning data into action. As the industry evolves, ESG must stay at the forefront—ensuring profitability, resilience, and a healthier planet for future generations.

Read MoreThe pressures on biodiversity are increasing, making it critical for the real estate industry to consider its impact, particularly across the Asia Pacific region where Southeast Asia alone hosts nearly 20% of the world’s known species within just 3% of the global land area.

Biodiversity contributes significantly to the functioning of ecosystem services such as clean air and water, climate regulation and disaster risk reduction which are essential for human well-being and economic stability. However, this is threatened due to this region’s rapid urbanization, deforestation, and agricultural expansion. For example, air and water pollution are the highest environmental risks that urban Asian cities face, with air pollution being the cause of one in five deaths in India in 2019, resulting in economic losses of USD 36 billion.

Driven by growing investor concerns and the need for robust ESG disclosures, regulatory trends are increasingly focusing on biodiversity. Initiatives like the UK's Biodiversity Net Gain (BNG) and the emergence of frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) are putting pressure on companies to disclose their environmental impacts and demonstrate how they are contributing to nature conservation.

The real estate sector, a significant contributor to biodiversity loss through land use, consumption of raw materials and disruption of natural cycles, is central to this shift. An upcoming white paper developed by CBRE in collaboration with Nature Positive and the Metis Institute acknowledges this and aims to explore the feasibility and benefits of incorporating biodiversity into green leases in Southeast Asia. Green leases serve as an important link between landlord and tenants on the sustainable objectives of a building, and including biodiversity within would help to integrate both party’s interests.

The white paper acknowledges several challenges when addressing biodiversity risks. Adoption and support for nature-based solutions is low due to weak legislation, lack of awareness, and maintenance difficulties . Additionally, the intangible benefits of nature-based solutions make it hard to justify the capital investments.

Despite these challenges, the real estate sector has a unique opportunity to turn the tide. By integrating biodiversity into urban development, the industry can enhance urban resilience to climate change effects, such as flooding and heatwaves, improving business continuity and urban liveability. Furthermore, properties that incorporate green spaces and biodiversity measures often see increased market values, as investors are attracted to the operability and resilience of the building, along with higher tenant satisfaction.

While the path forward is fraught with challenges, the potential benefits of addressing biodiversity risks present a compelling case for action within the real estate industry.

To get started, the real estate industry can consider the following actions.

Prioritising biodiversity should be a necessity in sustainable urban development in Asia Pacific before it is too late to salvage local ecosystems. By setting clear targets, engaging stakeholders, fostering collaboration, and prioritising quick wins, the real estate industry can play a crucial role in preserving the region's rich biodiversity while reaping significant economic and social benefits.

Head of ESG Consulting & Sustainability,

APAC, Paia FROM CBRE

Head of WELL & Circular Economy

Paia FROM CBRE

Head of Nature Solutions

Paia FROM CBRE