Rewriting the Playbook: Link’s Resilience-Linked Insurance Renewal 12 June 2025

This article is an excerpt from the the white paper “Sustainability-Linked Insurance: Rewarding Climate Risk Adaptation” co-published by Link Asset Management, AXA and Marsh.

For decades, the real estate industry has viewed insurance as a necessary cost of doing business — a safeguard against unforeseen risks, but rarely a tool for creating value.

That paradigm is shifting.

Link Asset Management (Link) has introduced how real estate climate resilience efforts can be linked with insurance terms — a model that doesn’t just provide protection but actively rewards investment in climate adaptation measures.

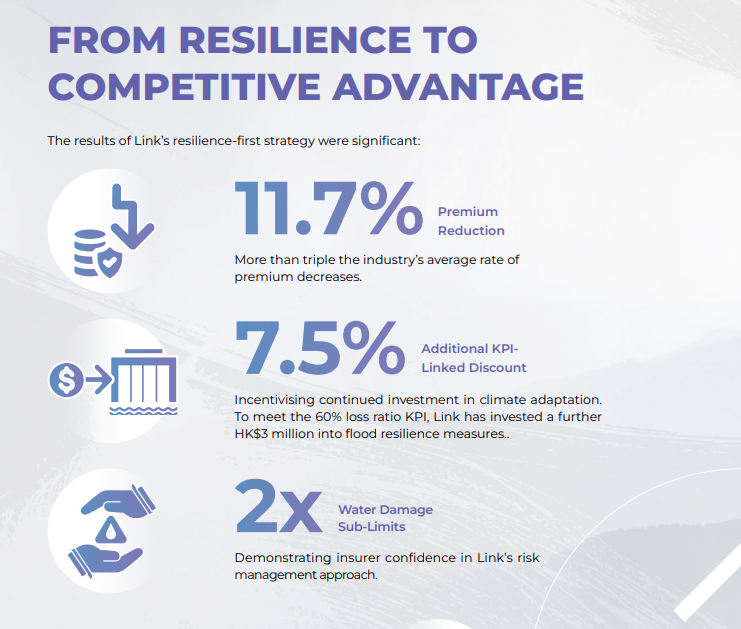

By quantifying climate risk and making targeted resilience investments, Link, through its insurance broker Marsh Hong Kong, secured an 11.7% reduction in property insurance premiums — significantly outperforming the industry’s ~3% average. Even more importantly, Link negotiated an additional 7.5% premium reduction tied to its loss ratio, creating a direct financial incentive to continue investing in long-term climate preparedness.

This case study isn’t just about one company’s success. Rather, it highlights a fundamental shift and real-time opportunity for real estate firms — and insurers — to align incentives and build climate resilience.

- As a reminder – that extreme weather events are already becoming more severe under climate change, leading to significant financial losses

- As a showcase – of proactive climate risk adaptation measures

- As a call to action – to leverage the mutually beneficial relationship between asset managers and insurers for building climate resilience

From Risk Awareness to Resilience in Action

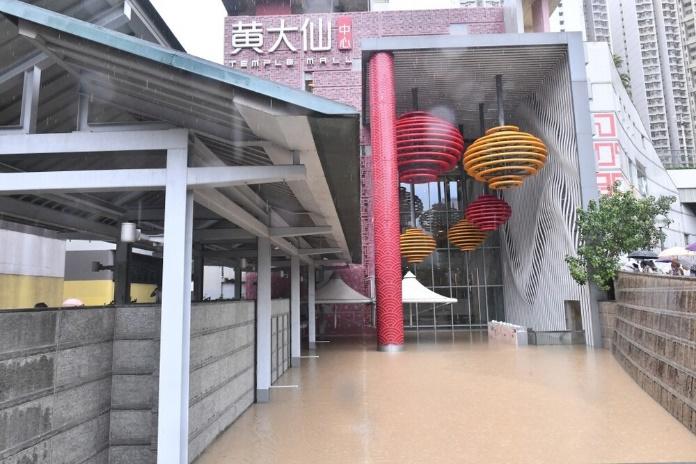

Extreme weather events are no longer an anomaly — they are an operational reality. In September 2023, Hong Kong experienced a “double whammy” of Super Typhoon Saola and record-breaking black rainstorms, causing widespread property damage. The conventional response across the real estate industry was reactive: filing claims, absorbing losses, and bracing for inevitable premium hikes.

Link chose a different approach. Rather than treating resilience as a cost, it saw an opportunity for investment — one that could be quantified, optimised, and ultimately rewarded.

Link reframed its relationship with insurers from a transactional one to a partnership in risk management:

- Worked with Marsh Hong Kong to embed resilience efforts into a resilience-focused insurance roadshow, bringing 22 insurers into early discussions.

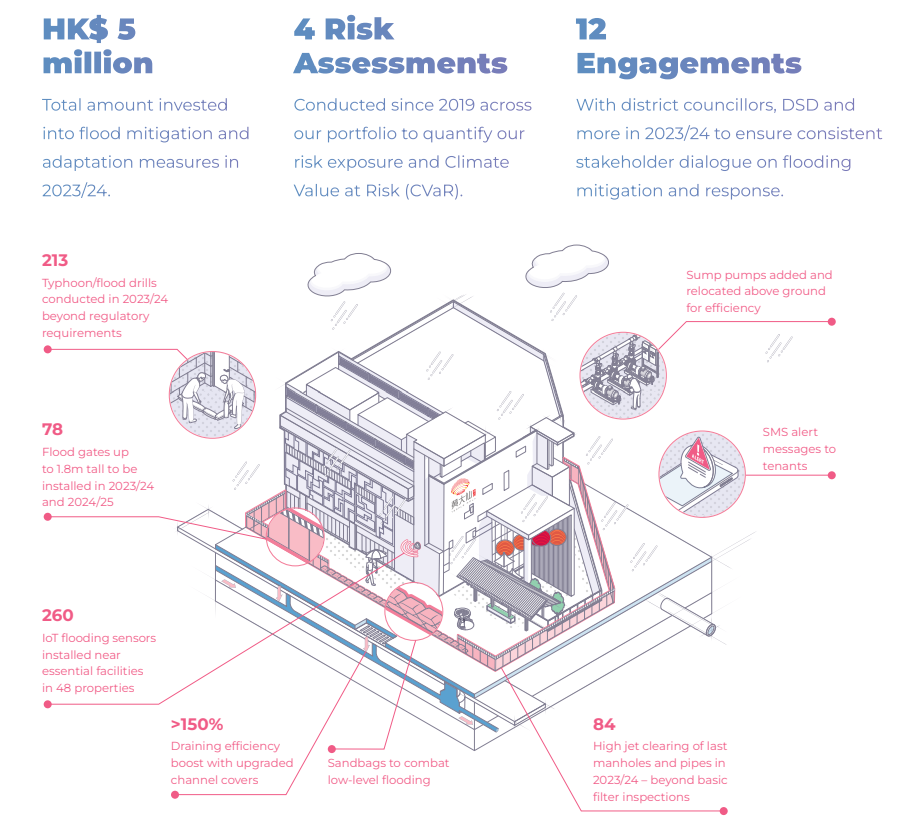

- Presented quantifiable evidence of risk reduction, showcasing Link’s HK$5 million investment into flood resilience measures.

- Collaborated with AXA on a Sustainability-Linked Insurance Proof-of-Concept, demonstrating how Link’s flood resilience measures could lower potential losses by 10- 20%.

- Negotiated performance-linked premium reductions, securing additional cost savings contingent on a low loss ratio and incentivising continued investment in resilience.

By integrating risk identification, targeted mitigation, and transparent insurer engagement, Link transformed resilience from a defensive measure into a financial advantage.

The Resilience Framework: Six Pillars of Climate Adaptation

Building a resilience-linked insurance model requires a structured, data-backed approach. Link’s framework consists of six interconnected pillars:

- Comprehensive Climate Risk Assessments

- Asset-Level Resilience Enhancements

- Standardised Emergency Protocols

- Preventive Maintenance and Drainage Optimisation

- Proactive Stakeholder Coordination

- Rapid Recovery and Business Continuity Planning

Each of these pillars feeds into Link’s resilience-linked insurance structure, ensuring measurable risk reduction, operational stability, and long-term financial savings.

From Resilience to Competitive Advantage

The results of Link’s resilience-first strategy were significant:

By embedding climate resilience into its operational and financial strategy, Link has proven that climate adaptation isn’t just a defensive measure — it’s a value driver.

“We welcome the efforts made by Link REIT to make their assets more resilient and sustainable, and are pleased to show our support through promising insurance capacity and T&Cs. Extreme weather and climate risk are real issues for real estate and best tackled when all stakeholders work together.”

- Quoted by one insurer on an anonymous basis

What’s next?

- For Real Estate Leaders: How can you integrate data-driven resilience into your portfolio strategy?

- For Insurers: How can underwriting models evolve to incentivise proactive climate adaptation?

- For Investors: How does climate resilience factor into long-term asset valuation?

Real estate is at a crossroads. Rising climate risks will continue to challenge traditional insurance models, but Link’s resilience-linked insurance structure offers a replicable blueprint for other asset owners.

The shift from reactive insurance to proactive risk management has begun — who will follow?